portability estate tax deadline

Phils 1158 million estate tax exemption was unused and Dora cannot claim the exemption without portability so Dora can only use her exemption of 1158 million when she passes away. To allow time for processing please wait at least 9 months after filing Form 706 to request a closing letter.

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

The current estate tax exemption is.

. Once the decedents estate discovered that in failing to file an estate tax return and elect portability the decedents spouses estate would not be entitled to the unused. If Wife fails to timely file Husbands federal estate tax return IRS Form 706 to elect Portability her total estate would be 60 million and she would only have her estate tax. The return is due nine months after death with a six.

The due date of an estate tax return required to elect portability is nine months after the decedents date of death or the last day of the period covered by an extension if an. July 17 2020. The portability election must be filed on a Form 706 by the the date a normal federal estate tax return must be filed 9 months after the date of death or 15 months with an.

The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return. On June 9 the IRS issued Rev. Portability allows a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption amount toward his or her own transfers during life or at death.

Beyond the unique opportunity that Revenue Procedure 2017-34 creates for couples where one spouse already passed away the good news of the new rules is that it. For a surviving spouse to properly make the election to use the deceased spouses unused estate tax exemption the surviving spouse must timely file IRS Form 706 United. To secure these benefits however the deceased spouses executor must have made a portability election on a timely filed estate tax return.

2017-34 2017-26 IRB which provides a more liberal timeframe for certain estates to. Estate tax portability means that the unused portion of the first-to-die spouses estate tax exemption passes to the surviving spouse. The deadline to request estate and gift tax portability has recently been extended from nine months to two years.

Files for portability soon she will additionally exempt that 3 million from her late husbands estate bringing her total exemption up to 849 million and her taxable estate down. The estate tax concept tax known as portability is permanent as a result of the enactment of the American Taxpayer Relief Act of 2012. The due date for filing an estate tax return is nine months after the date of death with an automatic six month extension if requested by the nine month due date.

Thus the estate tax rate is 40 and Doras estate is still worth 20 million. Portability allows a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption amount toward his or her own transfers. But if Susie Q.

The surviving spouse must file an annual return in order to take advantage of. Instead of an estate tax closing letter the executor of the estate may request an. November 5 2020.

In other words for DSUE portability to be claimed the executor must elect portability on the deceased spouses estate tax return. The IRS thankfully has made electing. If however a federal estate tax return is not required to be filed only then can a separate election be made for New York purposes similarly reflected on a pro forma federal.

If the estate representative did not file an estate tax return within nine months after the decedents date of death or within fifteen months of the decedents date of death if a six month extension of time for filing the estate tax return had been obtained the availability of an extension of time to elect portability of the DSUE amount depends on whether the estate has a filing requirement. The surviving spouses credit for this exemption must be transferred to a surviving spouse. Electing to use estate tax portability.

The federal Estate Tax commonly referred to as the death tax is a tax on a persons right to transfer property upon their death. In this post we will offer an example to illustrate how. Letss assume the estate tax exemption is still 114 million when Dora dies.

New Extended Deadlines for Portability Election Filing.

Should You Elect The Alternate Valuation Date For Estate Tax

Why File A Form 706 Estate Taxes Bridge Law Llp

It May Be Time To Start Worrying About The Estate Tax The New York Times

How Much Tax Do You Pay On Inheritance Legacy Design Strategies An Estate And Business Planning Law Firm

Estate Tax In The United States Wikiwand

Federal Estate Tax Return Irs Form 706

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Estate Tax Portability Preserving It For The Benefit Of Your Heirs

Form 706 Extension For Portability Under Rev Proc 2017 34

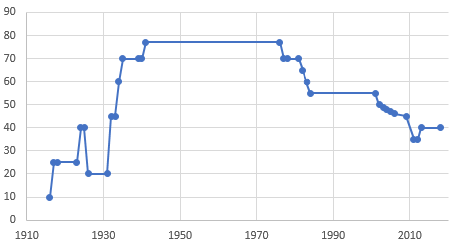

The Federal Estate Tax Is Back Ppt Video Online Download

Form 706 Extension For Portability Under Rev Proc 2017 34

Form 706 Extension For Portability Under Rev Proc 2017 34

Estate Tax In The United States Wikiwand

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Distributable Net Income Tax Rules For Bypass Trusts

Transfer To Limited Partnership Included In Taxable Estate Cpa Practice Advisor

Don T Forget About Making A Portability Election Capell Howard P C

What Surviving Spouses Need To Know About The Marital Portability Election Natural Bridges Financial Advisors